What Can Be Included on a Fire Claim?

10/30/2021 (Permalink)

What Information Can Be Included in a Fire Claim?

If a fire breaks out in your Trenton, OH, commercial building, the come back process can be difficult. Assessing the fire damage may overwhelm and confuse you. Some of the damage you found in your building couldn't possibly have been caused by the fire, so you may not know whether it can be included on your claim. Can your water-logged carpets be included on your insurance claim? As you try to figure out what counts as damage done by the fire, you need to remember the following:

- Flames affect structure, furnishings and equipment.

- Fire suppression causes water damage.

- Fire produces smoke and soot, which cause their own damage.

When you make your claim, you don't have to limit it to the damage done directly by the flames. Your fire restoration team may be able to help you better understand what you can include on your insurance claim.

Fire Damage

One of the main things your insurance adjuster will look for as he or she goes through your property is damage caused directly by the fire. This can include charred furniture, burnt walls and melted roof materials.

Fire Suppression Damage

Putting out a fire can cause damage too. Firefighters may have to add ventilation to your building to dampen and control the flames. This could mean breaking windows or cutting a hole in the roof. Suppression also requires lots of water, which means some of your building could be flooded or water logged.

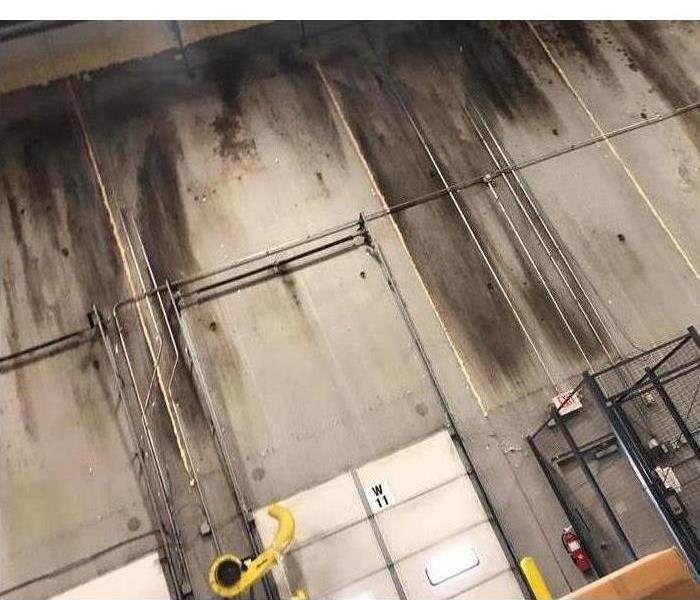

Smoke Damage

Part of fire mitigation is taking care of the smoke stains and odor left after the flames are put out. Smoke often affects electronic devices, clothing, carpets, walls and ceilings. You may be able to include the cleaning and restoration costs on your claim.

Fire damage is not solely caused by the flames that rip through your commercial building. Instead, this damage can also be done by the byproducts of the flames and the tools used to stop the spreading of the fire.

24/7 Emergency Service

24/7 Emergency Service